Oakland, California - Today, Hispanic Federation announced the second iteration of the HANDUp Financial Empowerment Initiative, and Centro Community Partners is one of 10 organizations across the country that are breaking down financial barriers for underserved communities by providing financial wellness courses for individuals, families and small businesses. Thanks to support from Wells Fargo, the HAND Up Financial Empowerment Initiative seeks to provide financial education training to 3,000 low to middle-income individuals, entrepreneurs, and small businesses across the country. As a part of the program, Centro Community Partners will empower individuals by offering culturally and linguistically relevant technical assistance and financial literacy programs to create thriving communities.

A Journey From Aspirations to Foundations

Mak's Journey to Success: Turning Dreams into Goals and Goals into Reality in Miami!

Mak, a proudly Cuban woman who arrived in the United States 10 years ago, started her entrepreneurial journey out of a moment of necessity and faith.. “Never underestimate the power of your dreams because when you pursue them with determination, success becomes inevitable,” Mak shares. With a life marked by the challenges of balancing work and family, she faced the harsh reality of being the sole breadwinner after her divorce. While working for two companies and considering driving for a platform, a prayer gave her the clarity she needed: to invest in her future and her community. That decision marked the beginning of a path filled with resilience and opportunities.

Forging Dreams and Building

Daniel Fonseca: Forging Dreams and Building a Legacy with Oasis Home Design in California

Daniel's story is an inspiring example of how resilience, passion, and love for one's roots can transform challenges into opportunities. Born in Colombia and raised in a family of creatives and entrepreneurs, Daniel grew up surrounded by a deep tradition of independence and hard work. From a young age, he observed his grandfather, a self-taught carpenter who left behind the poverty of mining towns to build a better future in the city, and his father, who continued that legacy by establishing himself as a construction entrepreneur in California.

Financial Planning for the Year Ahead

Financial Planning for the Year Ahead: Keys to Successful Financial Planning

Personal Financial planning is one of the most crucial steps to ensuring your personal success. With the beginning of a new year, now is the perfect time to set clear goals, evaluate your resources, and prepare for the opportunities and challenges ahead.

Creation from Nature & Urban Style

Intuitive Adornment: Creating from Intuition, Nature, and Urban Style in Miami

Rachell’s entrepreneurial story began in her teenage years, growing up in New York City, where the vibrant fashion industry left a lasting impression on her. Immersed in the urban landscape, she observed how elements of daily life, nature, and even the ocean could inspire creativity. Rae’s modeling career started at the age of 12, an experience that allowed her to develop a deep appreciation for the transformative power of fashion. "I love how a single piece of jewelry can make us feel beautiful, but also elevate any outfit," Rae shares. This insight shaped her journey as a jewelry designer, leading her to create her brand, Intuitive Adornment Jewelry, which reflects her intuitive and organic approach to life and design. Her jewelry combines bling and fashion with nature and feminine energy, making every woman who wears her creations feel special and beautiful.

Kickstart Your Business Goals for 2025

The start of a new year is the perfect time for entrepreneurs to dream big and set meaningful goals to start a new or existing business. Since our founding in 2010, Centro Community Partners (Centro) believes every entrepreneur deserves the support and resources to turn their vision into reality. You can make 2025 your most successful year! What are the right strategies and programs to get you there?

Teaching with Passion, Leading with Purpose

From Passion to Purpose: Cathleen Antoine-Abiala's Journey with Sajès Ed Consulting in New York

Cathleen Antoine-Abiala’s entrepreneurial journey began with a profound love for learning, storytelling, and cultural preservation. Inspired by her family’s rich history and traditions, Cathleen recognized the power of education and creativity in shaping identities and building communities. The loss of her mother deepened her commitment to honoring intergenerational knowledge, leading to the creation of Sajès Ed Consulting—a venture dedicated to helping individuals and communities uncover the stories and values that define their identities and futures.

Empowering Aging in Place: Karen Campbell’s Inspiring Entrepreneurial Journey In New York Living with Purpose: Empowering the Aging Process

Empowering Aging in Place: Karen Campbell’s Inspiring Entrepreneurial Journey In New York

Karen Campbell’s entrepreneurial journey is deeply personal, rooted in a story of love, loss, and resilience. My Age In Place Advocate (MAIPA) was born from a profound determination to protect families and honor the memory of her elderly parents, who were tragically victimized by a lottery scam. Reflecting on the heartbreak and helplessness she felt, Karen turned her grief into action, creating a business designed to safeguard the elderly from financial exploitation and help them age gracefully in the comfort of their own homes.

From Passion to Success

From Passion to Success: The Inspiring Journey of Juan Carlos Pacheco and Ceviche Pacha in San Francisco

In the heart of San Francisco, Juan Carlos Pacheco has transformed his lifelong love for Peruvian cuisine into Ceviche Pacha, a celebrated culinary venture that brings the vibrant tastes of Peru to a new audience. The journey that led to Ceviche Pacha wasn’t easy, but it is a testament to Juan Carlos's resilience, passion, and unshakable commitment to his dreams.

2024 Prosperity Now RISE Challenge Award

Centro Community Partners Secures Top Honors in 2024 Prosperity Now RISE Challenge for Groundbreaking CEO App

We’re thrilled to announce that Centro Community Partners (Centro) was recognized as the third-place winner in the prestigious 2024 Prosperity Now RISE Challenge Award. On September 3, this national competition honors projects that drive innovation and foster economic equity for underserved communities. Our very own Vernisha Williams, Manager of Strategic Partnerships, led Centro into the final round of the pitch competition in Maryland at the Prosperity Now Rise Conference.

Winner: PayPal Community Impact Grant!

We are pleased to announce that Centro Community Partners has been chosen as one of the recipients of the PayPal Community Impact Grant, which will provide generous support of $20,000. This grant acknowledges our organization's hard work and dedication to supporting entrepreneurs and underserved communities.

Metanoia Zone's Success with the Capital Hub Program: Ivette López González, an Entrepreneur

When she met Centro Community Partners, Ivette López's path took a transformative turn. She was seeking guidance in establishing her business, so she decided to enroll in Centro's basic and advanced entrepreneurship programs. Ivette honed her skills and expanded her vision. These programs teach entrepreneurs to think strategically, helping them analyze their market, develop their understanding of business operations, and learn about personal and business finance.

Empower your Future! New Programs to Achieve Business Success.

2024 Truist/MIT Foundation Inspire Award

The community voted for Centro Community Partners for its inspiring vision of delivering a socioeconomic community-based solution that provides fair and inclusive access to a national virtual hub of resources tailored to small business owners, particularly focusing on empowering low-income women and BIPOC entrepreneurs in underserved communities.

Finalist for the Inspire Awards

Centro awarded an eBay Foundation Global Give grant for the third year!

At Centro Community Partners, we are thrilled to announce that we have been selected once again as recipients of the eBay Foundation Global Give grant for the year 2023. This marks the third time we've had the honor of receiving this generous grant, and we are immensely grateful to the eBay Foundation for their continued support of our mission to empower low-income women and minority entrepreneurs.

Last year, we were fortunate to be among the grantees of the 2022 Global Give grant program, and this support played a pivotal role in enabling us to make significant strides in advancing access to capital, offering personalized business advisory services, and providing capacity-building programs to other nonprofits. Through this collaboration, we were able to collectively impact the lives of over 150 underrepresented entrepreneurs in both the Bay Area and New York City, fostering growth and economic opportunity in communities that needed it the most.

The eBay Foundation has consistently demonstrated a deep commitment to promoting entrepreneurship among historically marginalized groups. Since its inception in 1998, the foundation has been partnering with nonprofit organizations dedicated to dismantling barriers to entrepreneurship for individuals from diverse backgrounds. Their belief that successful entrepreneurs contribute to more resilient and vibrant communities aligns seamlessly with our own mission.

We are committed to making the most of this year's Global Give grant to continue our vital work in empowering women and minority entrepreneurs.

Thank you once again to the eBay Foundation for their unwavering support. Together, we are making a difference, serving one entrepreneur at a time!

You can learn more about the eBay Global Give grant here.

Mother's Entrepreneurial Spirit Igniting a Lifelong Passion

“Be resilient and believe in your ability to make a positive impact” - Ashanti

Ashanti Thomas-Mack is a passionate and ambitious entrepreneur living in Brooklyn, NY. She is the founder of Keep It Tight, and together with her husband and co-founder Shon Mack, they offer cosmetic surgery support and recovery care. Ashanti’s entrepreneurial spirit burned brightly within her, fueled by a desire to make a positive impact in people's lives.

Ashanti Thomas-Mack is a passionate and ambitious entrepreneur living in Brooklyn, NY. She is the founder of Keep It Tight, and together with her husband and co-founder Shon Mack, they offer cosmetic surgery support and recovery care. Ashanti’s entrepreneurial spirit burned brightly within her, fueled by a desire to make a positive impact in people's lives.

Ashanti has always been driven and ambitious, and she always knew she wanted to be an entrepreneur. “From a young child, I had the taste of entrepreneurship from my mother. My mother, well, my family, migrated from Guyana. She had the skills, talent, and drive to make something out of nothing. I always heard stories that my mother was the “Trade woman”, selling gold and goods in Trinidad, Barbados, Grenada, and Syrunam. I remember the first time I saw my mom in action. It was Juvet night, we were selling baked and saltfish with coffee, then the next day, which was the Labor Day parade, we had a table full of food, coolers full of drinks under a tent with our flags representing my family roots, making money and making people happy. Then, I realized my mom was making money from the food she made. That showed me you can make money for yourself. Be your own boss.” - Ashanti

Ashanti's story began in the heart of Brooklyn, where she worked as a dental office manager. Despite her professional success, she yearned for something more. Deep within her, a flame of ambition and creativity flickered, waiting to be ignited. Ashanti dreamed of creating a company that would provide comprehensive support for individuals undergoing elective surgeries, a company that would be their guiding light through the entire surgical journey.

Navigating the Unknown

It was during her own traumatic surgical experience that Ashanti found the inspiration she needed to take the leap. She had traveled to Florida in 2020 to get surgery, but the aftermath was far from what she had anticipated. Her recovery process was unsafe and poorly managed, leaving her disillusioned and determined to create a safe haven for others in similar situations. With a burning passion and a vision in her heart, Ashanti founded Keep It Tight, a company dedicated to providing pre and post-surgical support for individuals undergoing elective surgeries.

Starting a business in the healthcare industry proved to be no small feat for Ashanti. She faced numerous challenges, including finding the right resources, understanding the complex healthcare landscape, and building trust and credibility within the community. But Ashanti's unwavering determination pushed her forward, and it was during this time that she discovered the transformative power of Centro's entrepreneurship programs.

“What I like most about being an entrepreneur is the opportunity to make a difference in people's lives. Knowing that I am providing a service that is genuinely needed and that I am helping individuals through a difficult and often overlooked process brings me great satisfaction. It's rewarding to see the positive impact we can make on our clients and the community.” - Ashanti

Finding The Guiding Light

“Before Centro, I had concerns about the feasibility of starting my own business in the healthcare field. I was unsure about the resources available, the steps involved, and how to navigate the healthcare industry. Additionally, I had concerns about building trust and credibility with potential clients and partners.” - Ashanti.

Through Centro's Entrepreneurship Bootcamp, Ashanti found the support and guidance she needed to navigate the uncharted waters of entrepreneurship. The Centro Business Planning App became her trusted companion, providing her with a clear outline to write her business plan. It was a revelation, an empowering tool that gave her the structure and confidence to articulate her vision.

“Since joining Centro, I have had the opportunity to connect with a network of like-minded entrepreneurs and industry experts. This has opened doors for collaborations, partnerships, and continuous learning. Centro has also provided me with ongoing tools and access to additional resources, which have been instrumental in the growth and success of Keep It Tight.” - Ashanti

In 2023, Ashanti graduated from the Advanced Entrepreneurship Program, where she delved deeper into her business plan, discovering the importance of setting smart goals and executing them with precision and focus. She harnessed the knowledge and insights gained from Centro's programs, sharpening her skills in business development, financial management, and marketing strategies. “I would highly recommend Centro to my friends and family. The programs, resources, and support they offer are invaluable for aspiring and existing entrepreneurs. Centro is a trusted and reliable partner that genuinely cares about the success and well-being of entrepreneurs. I am grateful for the opportunities and guidance they have provided me.” - Ashanti

Unleashing Her Potential

Armed with newfound knowledge, Ashanti's entrepreneurial journey began to take flight. Keep It Tight started to grow, reaching new milestones and making a lasting impact on the lives of its clients. Ashanti's unwavering dedication and her team's collective passion propelled them forward, inspiring positive changes within the elective surgery industry.

“My advice to other entrepreneurs is to stay focused on your vision and never compromise on your values. Surround yourself with a strong support system, whether it's through mentors, peers, or professional organizations. Seek guidance when needed and be open to learning from both successes and failures. Don't be afraid to ask for help! Most importantly, be resilient and believe in yourself and your ability to make a positive impact. Don't base your success on others' wins or failures. This is your journey, you're in control.”- Ashanti

Today, Keep It Tight operates in the vibrant streets of New York City, supporting individuals through their surgical journeys with compassion and expertise. Ashanti's vision is boundless, and she has set her sights on expanding their services and reaching a wider audience. With their MWBE certification and plans to become ABCDE certified, Keep It Tight is poised for even greater success.

“Keep It Tight has contributed to the community by promoting safety and proper care within the elective surgery industry. We prioritize the well-being of our clients and strive to educate them about the importance of selecting qualified surgeons, obtaining medical clearance, and taking appropriate pre & post-operative measures. By providing comprehensive support and guidance, we aim to ensure a positive and safe surgical experience for our clients. Another way we foster through the community is through our brand ambassadors. These are individuals who have been through their own surgical journeys with Keep It Tight and are passionate about spreading the message of safety, support and self-care. Our big sister program and clothing drives will also be our contribution to the community. “ - Ashanti

Ashanti's success story would not be complete without acknowledging the incredible support she received throughout her journey. Her husband, Shon Mack, children, and team members have been her unwavering pillars of strength. They believed in her vision and stood by her side, offering encouragement, assistance, and unwavering support.

Looking to the Future

Currently, Keep It Tight is operating in New York City. They are MWBE Certified and working on becoming ABCDE certified, and have serviced over 45 clients since 2021. Ashanti has a dedicated team of professionals working with her. Her team includes , district manager-registered nurse, district manager-massage therapists, mobile massage therapist, support liaison, caretakers (PCA, CNA,CMA), administrative staff, and interns.

Ashanti envisions a future where Keep It Tight becomes a household name in pre and post-surgical support. Her goals are ambitious, yet she approaches them with the same unwavering determination that has carried her this far. She plans to establish a 24/7 short-term care facility, purchase additional ambulances, forge partnerships with renowned surgeons, and hire dedicated healthcare professionals. Keep It Tight will be a beacon of care and compassion, serving individuals not just in New York City but across the globe.

Join us in congratulating Ashanti for being brave and following her dreams! If you are in New York and want to learn more about her services, you can visit Keep It Tight and her Instagram.

2023 Q2 Update

We are excited to share some updates regarding our impact in helping entrepreneurs access training, coaching and capital. You can now see our latest impact statistics on our Overview page. We also want to celebrate and thank you for your support on the pre-sale campaign of Arturo’s new book.

ENTREPRENEURS SERVED

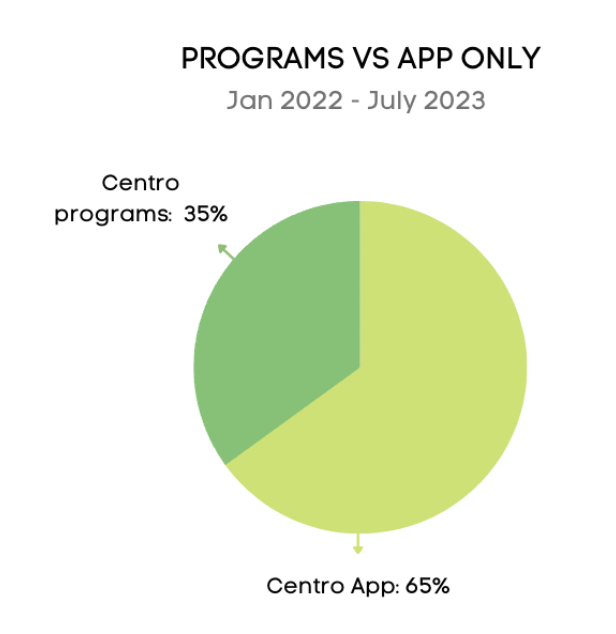

In the first half of 2023, we served 551 entrepreneurs, 167 of whom attended our training programs.

Through our programs, the Capital Hub and our app, we are on track to help more than 1,089 entrepreneurs by the end of this year.

As we continuously strive to support entrepreneurs, we are excited to introduce the beta version of our latest initiative: the Online Self-Paced Bootcamp. This innovative and flexible learning opportunity is specifically designed for entrepreneurs who are unable to attend a scheduled online course or prefer to learn at their own pace. With a range of self-paced learning modules that include video and written lessons, this beta version provides a valuable opportunity for individuals to engage in independent study and shape the future direction of the program.

ACCESS TO CAPITAL

Our Capital Hub has been helping entrepreneurs access interest-free loans through Kiva, and we are proud to announce that over the last three months, we helped 23 entrepreneurs receive a total of $211,000 in Kiva loans.

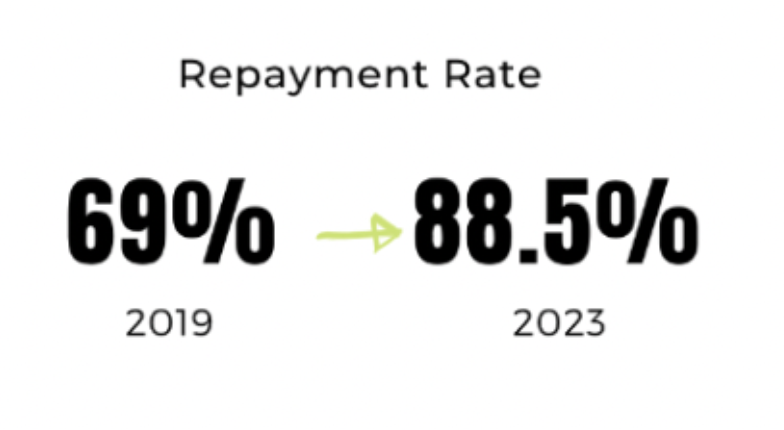

We have significantly improved the repayment rate to 89% (from 69% in 2019), showing the commitment of borrowers to pay their loans on time, as well as the positive use of the Centro Business Planning App. All borrowers that are not backed by an organization are required to go to the business planning activities on our app which help them think through their business model, which mitigates the risk of them falling behind on repayments.

This achievement not only highlights their dedication to the success of their businesses but also emphasizes the effectiveness of our support systems, including the Centro Business Planning App.

Through the SEED initiative, Immigrants Rising offers grants to entrepreneurs who are starting or growing a business in California. The opportunity is intended for undocumented individuals and people who have been granted Deferred Action for Childhood Arrivals (DACA) and Temporoary Protected Status (TPS), as well as those with limited English proficiency. This funding aims to empower immigrants to become successful business owners, contributing to the local economy and their communities. The Centro Capital Hub was able to provide support with the application process and helped 7 entrepreneurs apply for the Immigrants Rising’s SEED $5,000 Grant.

ONE-ON-ONE ASSISTANCE

Our team of coaches has been working to provide one-on-one coaching to 113 entrepreneurs in the first half of this year to support them in specific challenges with their businesses. We are on track to support 226 entrepreneurs by the end of the year.

We have provided a total of 13,406 hours of coaching since we started, and in 2023, we have already provided 186 hours of coaching to entrepreneurs in many locations, with most of them located in Oakland, San Jose, Santa Clara, Stockton and other Bay Area counties.

THANKS FOR SUPPORTING THE PRE-SALE OF “IN PURSUIT OF A NOBLE CAUSE” NEW BOOK BY ARTURO NORIEGA

We're happy to share that Arturo Noriega's pre-sale campaign for his upcoming book, "In Pursuit of a Noble Cause" has been a resounding success!

During the pre-order period, Arturo received overwhelming support from eager readers and advocates of positive change. By securing a pre-order, you have not only demonstrated your enthusiasm for this exceptional book but have also ensured that you will be among the first to receive it upon its release in September.

We would like to express our deepest gratitude to all the supporters who participated in Arturo Noriega's pre-sale campaign. Your unwavering enthusiasm and commitment have played an instrumental role in making this campaign a resounding success. By pre-ordering the book, you have secured your place as one of the first recipients when it officially releases in September.

As we eagerly await the release of "In Pursuit of a Noble Cause," let us celebrate Arturo's triumph and anticipate the invaluable wisdom that awaits us within the pages of this remarkable book.

Socio destacado de E-Suite: Urban Business Support

Hoy queremos destacar a uno de nuestros socios destacados de E-Suite, Urban Business Suppor, una organización sin fines de lucro con sede en Washington dedicada a apoyar a empresas propiedad de mujeres y minorías.

Oliver Scott es el director ejecutivo de Urban Business Support. Su misión es brindar capacitación en planificación empresarial y asistencia financiera a pequeñas empresas. Urban Business Support cree firmemente que las inversiones en comunidades de bajos ingresos deben beneficiar a las personas que viven y trabajan allí.

"Nuestra visión es el desarrollo sin desplazamiento. Creemos que la inversión en comunidades de bajos ingresos debe beneficiar a las personas que viven y trabajan allí. Y nuestra misión es brindar capacitación en planificación empresarial a empresas en vecindarios en proceso de gentrificación. También brindamos asistencia financiera en forma de subvenciones a estos propietarios de negocios". - Oliver

El Camino de Construir Una Organización

Urban Business Support ha sido nuestro socio de E-Suite desde 2018. Oliver recordó su relación de larga data con Centro Community Partners, ya que conoce a Arturo Noriega, fundador y CEO de Centro, desde que se fundó la organización.

Compartió cómo Urban Business Support comenzó a utilizar la Centro Business Planning App y nuestro plan de estudios para brindar una capacitación integral en planificación empresarial a sus emprendedores. La asociación con Centro desempeñó un papel crucial para que Urban Business Support despegara, brindándoles orientación y materiales.

"Comencé a impartir capacitación en planificación empresarial y conocía la aplicación de planificación empresarial de Centro. Inmediatamente fui a hablar con Arturo y Naldo al respecto, ya que sabía que quería usar la aplicación. Así que cuando decidí comenzar una organización, contacté de inmediato a Centro. De lo contrario, no conocía a nadie más a quien quisiera usar para el plan de estudios, y no quería diseñar el mío propio, por lo que Centro proporcionó la solución perfecta, la Suite de Emprendimiento. Y gracias a eso pude comenzar esta organización". - Oliver

Desatando el potencial EMPRENDEDOR

Urban Business Support se enfoca principalmente en servir a empresas propiedad de mujeres y minorías en vecindarios en transición. Oliver reconoce los desafíos que enfrentan los emprendedores en estas comunidades, particularmente en el acceso a capital. Para abordar esto, Urban Business Support inició un programa de subvenciones para ofrecer asistencia financiera a emprendedores que a menudo no son elegibles para préstamos tradicionales. Ofrecen $5,000 al mejor plan de negocios entre sus graduados. Este apoyo financiero no solo ayuda a los emprendedores a superar las barreras de financiamiento, sino que también les proporciona los recursos necesarios para prosperar y tener éxito en sus emprendimientos comerciales.

Urban Business Support se dedica a empoderar a los emprendedores y realiza anualmente doce campamentos y cuatro programas de emprendimiento con el plan de estudios de Centro. Los campamentos, diseñados para ser intensivos y eficientes en tiempo, brindan a los participantes una versión condensada de la capacitación en planificación empresarial utilizando la aplicación de planificación empresarial de Centro. Por otro lado, los programas de emprendimiento ofrecen un plan de estudios más completo, equipando a los participantes con una comprensión más profunda de varios aspectos del desarrollo empresarial.

Desde su fundación, Urban Business Support ha capacitado con éxito a un impresionante grupo de aproximadamente 300 emprendedores. "Mi primer objetivo era capacitar a 100 emprendedores, y llegamos a 75. Nuestro segundo año, lo hicimos muy bien, capacitando a unos 160".

Solo en el año fiscal actual, 70 emprendedores ya se han beneficiado de los programas transformadores de Urban Business Support. Esto demuestra el compromiso de la organización de fomentar un ecosistema empresarial próspero y empoderar a las personas para que logren sus objetivos comerciales.

Afrontando desafíos y construyendo hacia metas futuras

A pesar de sus logros, Oliver reconoció los desafíos que enfrentan al mantener asociaciones de referencia, lo que resultó en una ligera disminución en la participación en los programas. Oliver se mantiene firme en sus esfuerzos por restaurar estas asociaciones y cumplir con el objetivo de capacitar a 250 emprendedores para este año fiscal. Oliver enfatizó que Urban Business Support ofrece subvenciones de $5,000 para premiar el plan de negocios más ejemplar de sus emprendedores graduados, brindando un poderoso incentivo para el éxito empresarial.

Oliver también enfatizó que el apoyo de Centro Community Partners, especialmente a través de su aplicación y plan de estudios, desempeñó un papel vital en el éxito de Urban Business Support. El plan de estudios y el apoyo de Centro permitieron a Urban Business Support aprovechar su potencial para lograr un impacto positivo. Oliver también compartió que ha recomendado la E-Suite de Centro a otras organizaciones, reconociendo el valor que ofrece al empoderar a los emprendedores.

Urban Business Support, bajo el liderazgo de Oliver Scott, ha logrado avances significativos en el empoderamiento de emprendedores en vecindarios en proceso de gentrificación. A través de su asociación con Centro, han podido brindar valiosa capacitación en planificación empresarial y asistencia financiera, ayudando a los emprendedores a hacer realidad sus sueños al tiempo que contribuyen al desarrollo de la comunidad. Con su compromiso con el crecimiento inclusivo y su dedicación a su misión, Urban Business Support continúa creando un impacto duradero en las comunidades a las que sirven.

"Si no fuera por Centro, no habría podido iniciar la organización. La aplicación de planificación empresarial de Centro es increíble, cubre los conceptos básicos de un plan de negocios, y podemos hacerlo en un campamento intensivo de un día. Si no fuera por la aplicación y el plan de estudios de Centro, no estaríamos donde estamos hoy". - Oliver Scott

Si desea obtener más información sobre cómo también podemos ayudar a su organización, contáctenos en esuite@centrocommunity.org. ¡También estaremos encantados de responder cualquier pregunta sobre nuestro plan de estudios actual, herramientas de aprendizaje y enseñanza y el apoyo que brindamos a las organizaciones!

Featured E-Suite Partner: Urban Business Support

Today we want to highlight one of our Featured E-Suite Partners, Urban Business Support, a non-profit organization based in Washington dedicated to supporting women and minority-owned businesses.

Oliver Scott, is the Executive Director of Urban Business Support. Their mission is to provide business plan training and financial assistance to small businesses. Urban Business Support firmly believes that investments in low-income communities should benefit the people who live and work there.

“Our vision is development without displacement. We believe that investment in low-income communities should come to the benefit of the people who live and work there. And our mission is to provide business plan training to businesses in gentrifying neighborhoods. We also provide financial assistance in the form of grants to these business owners.” - Oliver

The Journey of Building an Organization

Urban Business Support has been our E-Suite Partner since 2018. Oliver recounted his longstanding relationship with Centro Community Partners, having known Arturo Noriega, Founder and CEO of Centro since the organization was founded.

He shared how Urban Business Support started using Centro Business Planning App and our curriculum to provide comprehensive business plan training to their entrepreneurs. The partnership with Centro played a crucial role in getting Urban Business Support off the ground, providing them with guidance and materials.

“I started doing business plan training, and I knew about the Centro Business Planning App. I immediately went to Arturo and Naldo to talk about it, as I knew that I wanted to use the app. So when I decided to start an organization, I immediately contacted Centro first. Otherwise, I didn't know of anybody else that I wanted to use for the curriculum, and I didn't want to design my own, so Centro provided the perfect solution for it, the Entrepreneurship Suite. And thanks to that I was able to start this organization.” - Oliver

Unleashing Entrepreneurial Potential

Urban Business Support primarily focuses on serving women and minority-owned businesses in transitioning neighborhoods. Oliver acknowledges the challenges faced by entrepreneurs in these communities, particularly in accessing capital. To address this, Urban Business Support initiated a grant program to offer financial assistance to entrepreneurs who are often ineligible for traditional loans. They offer $5,000 to the best business plan among their graduates. This financial support not only helps entrepreneurs overcome funding barriers but also provides them with the necessary resources to thrive and succeed in their business ventures.

Urban Business Support is dedicated to empowering entrepreneurs and annually conducts twelve boot camps and four entrepreneurship programs with Centro’s curriculum. The bootcamps, designed to be intensive and time-efficient, provide participants with a condensed version of the business plan training using the Centro Business Planning App. On the other hand, the entrepreneurship programs offer a more comprehensive curriculum, equipping participants with a deeper understanding of various aspects of business development.

Since its foundation, Urban Business Support has successfully trained an impressive cohort of approximately 300 entrepreneurs. “My first goal was to train 100 entrepreneurs, and we made it to 75. Our second year, we did really well, training about 160.”

In the current fiscal year alone, 70 entrepreneurs have already benefited from Urban Business Support’s transformative programs. This demonstrates the organization's commitment to fostering a thriving entrepreneurial ecosystem and empowering individuals to achieve their business goals.

Embracing Challenges and Building Towards Future Goals

Despite their achievements, Oliver acknowledged the challenges faced in maintaining referral partnerships, which resulted in a slight decline in program participation. Oliver remains resolute in his efforts to restore these partnerships and fulfill their objective of training 250 entrepreneurs for this fiscal year. Oliver emphasized that Urban Business Support grants of $5,000 to award the most exemplary business plan from their graduating entrepreneurs, providing a powerful incentive for entrepreneurial success.

Oliver also emphasized that the support from Centro Community Partners, especially through their app and curriculum, played a vital role in Urban Business Supports success. Centro's curriculum and support enabled Urban Business Support to secure their potential for positive impact. Oliver also shared that he has recommended Centro Entrepreneurship Suite to other organizations, recognizing the value it offers in empowering entrepreneurs.

Urban Business Support, under the leadership of Oliver Scott, has made significant strides in empowering entrepreneurs in gentrifying neighborhoods. Through their partnership with Centro, they have been able to provide valuable business plan training and financial assistance, helping entrepreneurs realize their dreams while contributing to community development. With their commitment to inclusive growth and dedication to their mission, Urban Business Support continues to create a lasting impact in the communities they serve.

“If it wasn't for Centro, I wouldn't have been able to get the organization started. The Centro Business Planning App is amazing, it covers the basics of a business plan, and we're able to do it in a Bootcamp in just one day. If it weren't for the App and for Centro's curriculum we wouldn't be where we are today.” - Oliver Scott

If you want to learn more about how we can also help your organization, please contact us at esuite@centrocommunity.org. We are also happy to answer any questions about our current curriculum, learning and teaching tools, and the support we provide to organizations!